Here we will go through what mutual funds are, different types of mutual funds and what are the things one needs to look at before investing in a Mutual Fund for the long term.

What are mutual funds?

- A mutual fund is a pool of money collected from a number of investors, managed by a professional Fund Manager.

- The money collected in a mutual fund scheme is invested based on the scheme’s investment objective. E.g. Equity based Fund will invest in stocks while debt based funds invest in Debentures or bonds.

- Mutual funds have Net Asset value (NAV), which tells the market value of a unit of Mutual Fund.

- E.g. If a mutual fund has 100 units and market value of 1,000 Rs then NAV will be 10 i.e. each unit value is 10 Rs.

- Mutual Fund charge fee for managing the funds which is in percentage of managed funds i.e. expense ratio.

- Mutual funds are categorized based on the investment objective. Which we will see in the next section.

Type of Mutual Funds

Mutual funds come in many varieties, designed to meet different investor goals. Mutual funds can be broadly classified based on:

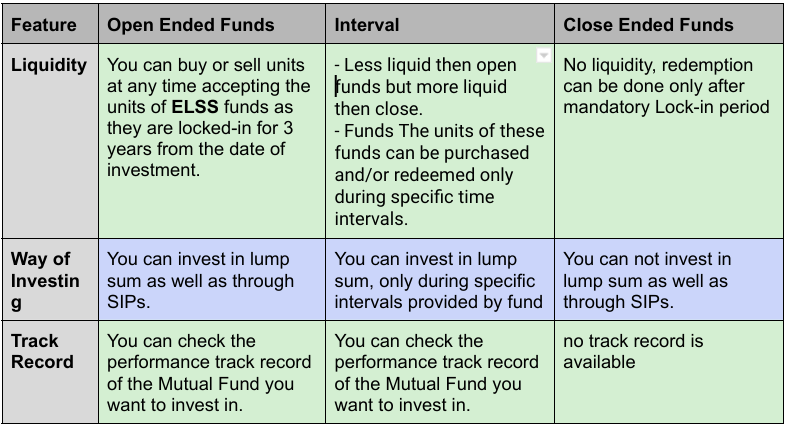

- Organisation Structure – Open ended, Close ended, Interval

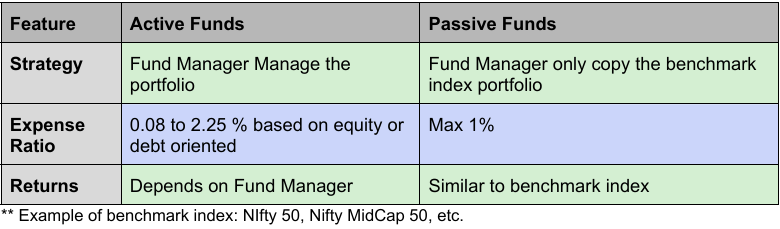

- Management of Portfolio – Actively or Passively

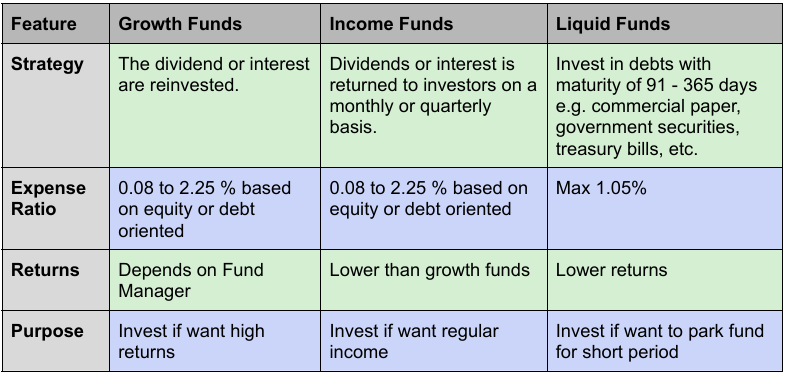

- Investment Objective – Growth, Income, Liquidity

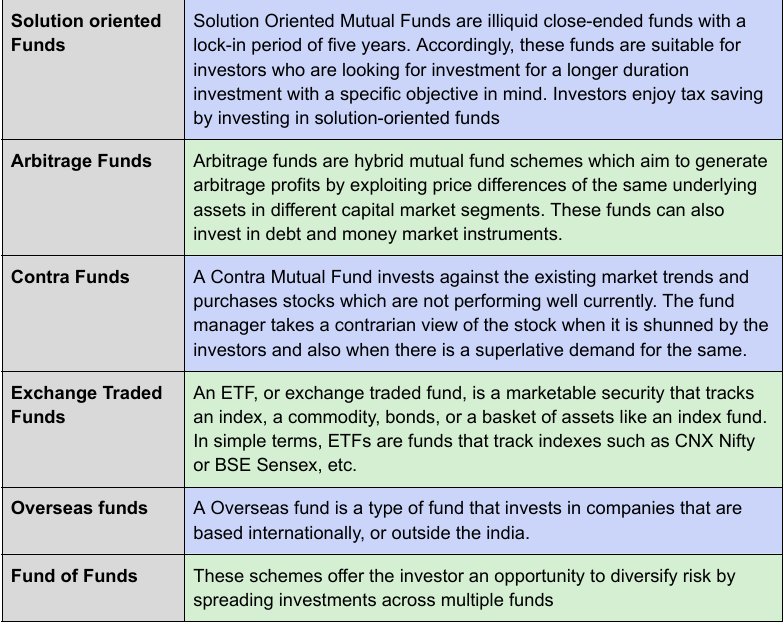

Further Mutual funds can be categorized based on underlying Portfolio:

- Equity, Debt, Hybrid, Money market instruments, Multi Asset

- Tax saving, Thematic, Solution oriented, Arbitrage, contra

- Exchange Traded Funds

- Overseas funds

- Fund of funds

Open Ended Vs Close Ended Funds

Active Vs Passive Funds

Growth Vs Income Vs Liquid Funds

categorized based on underlying Portfolio

How to Decide which Mutual Fund to invest in

With so many options one must be wondering which type of mutual fund is good for him/her. So, before one looks at where to invest one needs to understand why he/she is investing in a mutual fund.

There are three major reason for investing in mutual fund i.e.

- Get good returns without being involved in monitoring and analyzing investments.

- Want to save tax while getting better returns than fixed investments like Tax saving FD.

- Want regular income with return better than the fixed investments like FD.

Identity mutual fund which can provide a good returns or regular income

To identity good fund one need to look out for the following line items:

- Look for the fund track record:

Typically, when the stock market is doing well, new funds flock to the market. That means many funds are relatively new, thus lacking any kind of long-term track record to judge them by. This alone should make you cautious. You must thus always look for funds with track records spanning both bear and bull market environments, which is generally true for funds that have been around for at least 10 years.

- Look for lower expense ratio:

Mutual fund management fee (expense ratio) can eat a lot into your long term return. Thus it’s important to find low-cost funds. Here is an example

- If the invested amount is 1,00,000 and average return per year is 12% and investment period is 10 years.

- If the management fee is 0% → 960000 will be after 20 years

- If the management fee is 1% → 800000 will be after 20 years (-16,000)

- If the management fee is 2% → 670000 will be after 20 years (-29,000)

- Look for the best managers

Determining whether the fund manager is good or not, analysis fund manager is a difficult task but one can look in the history of fund manager and see if he is fulfilling the 3 given criteria:

- Fund manager experience: Managers who have been investing for years, if not decades. This ensures that the manager has been on the job in both bull markets and bear markets.

- Fund manager performance: over the long period (usually 10 years) with the same fund, and how well he has outperformed the markets during this period. As one can have 1-2 good years but consistency is what one must look out for.

- Fund manager investment philosophy: understand whether he has been using the same investment philosophy throughout its history or not or does he change his stripes to fit the latest investing fad.

- Look for the slow turners

Excessive trading (buying and selling) can reduce your stock returns. Yes, mutual funds sometimes are forced to buy and sell stocks to take care of sudden fund inflow and outflow, but a high turnover ratio of stocks impacts the investment return.

Turnover ratio over year tells what % of the fund portfolio is replaced by new stocks.

turnover time =100turnover ratio

E.g. If the turnover ratio is 50% then in 2 years the whole portfolio will change.

The average portfolio turnover of all diversified equity mutual funds in India is around 60%. Go for funds that have a turnover ratio less than this lesser the better.

- Look for the old-fashioned

Another factor to look for in a well-performing mutual fund is whether it has stuck to this winning strategy for long or not. Means not buying just because of market appreciates.